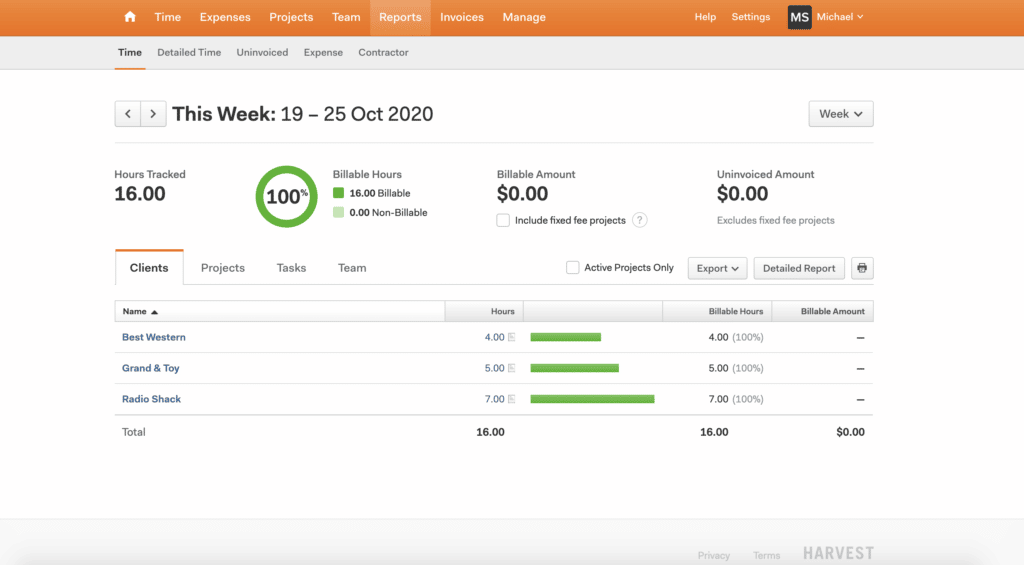

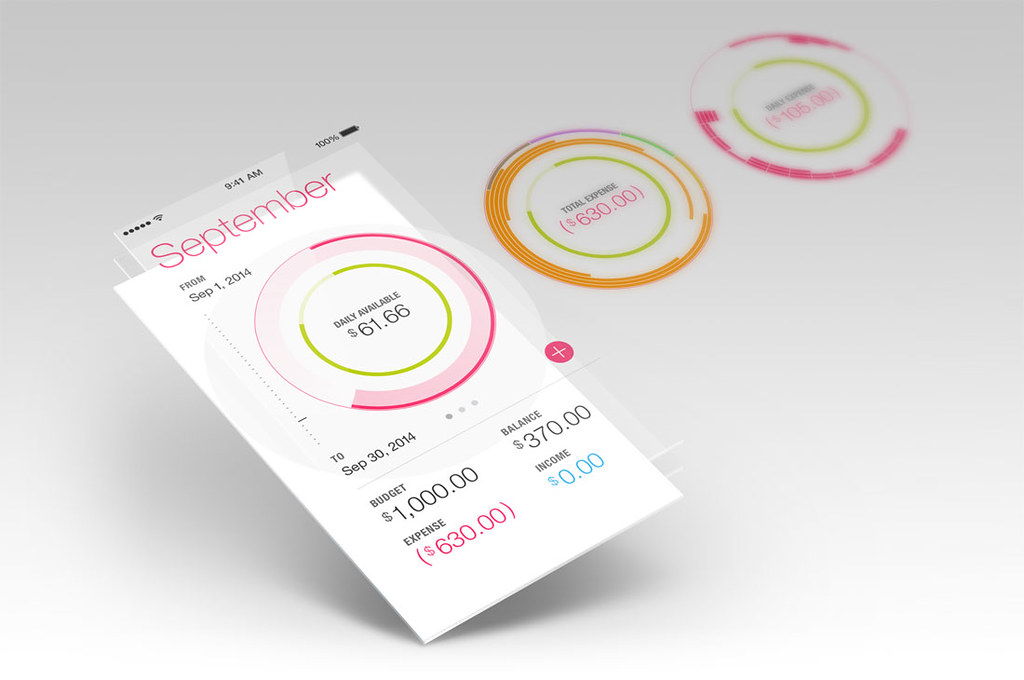

Keeping your finances in check can feel overwhelming. But don’t worry—2025 brings a host of modern tools designed for tracking expenses in simpler, smarter ways. Whether you’re a business owner juggling multiple corporate card accounts or a freelancer aiming to categorize every common expense, there’s a solution out there that matches your financial goal. Let’s explore ten of the best apps to keep your financial workflow in tip-top shape.

Use this guide to pinpoint user-friendly interfaces, assess real-time reporting capabilities, and figure out which financial tool integrates seamlessly with your existing financial system. By the end, you’ll have a clear idea of how each expense tracking app can simplify your day-to-day spending activities, from corporate card reconciliation to personal savings goals.

1. Expensify: The All-in-One Solution for Tracking Expenses

Expensify has long been known as a comprehensive expense management tool. It’s well-loved for its intuitive design and powerful features that simplify the entire expense reporting process.

Key Features

- AI-Powered Receipt Scanning: Its SmartScan feature automatically captures receipt details, saving you time for employee reimbursements and reducing manual entry errors.

- Corporate Card Reconciliation: Ideal for a business expense workflow, it ensures every corporate card transaction is tracked meticulously.

- Real-Time Data Sync: Monitor day spending and watch your financial account balances update immediately.

- Integration with Accounting Software: Sync seamlessly with popular platforms like QuickBooks, Xero, and Oracle, making Expensify a reliable choice for large or small businesses.

- Customizable Reporting: Generate a detailed expense report or custom report to gain in-depth insights into your spending pattern.

If you’re a business owner who wants visibility into spending pattern data, Expensify’s automation capability and corporate card solution can be a game-changer. It also offers a customizable approval workflow that streamlines policy compliance checks and reduces the time for employee reimbursements.

2. Zoho Expense: Budgeting Made Easy

Zoho Expense stands out as a user-friendly interface that helps companies handle travel expense tracking and everyday business expenses. Whether you’re just starting or looking to manage a large finance team, Zoho Expense offers a comprehensive solution.

Why It Shines

- Advanced Receipt Management: It automatically extracts data using receipt capture, minimizing manual data entry.

- Multi-Currency Support: Perfect for businesses dealing with international transactions, it simplifies expense policy across multiple currencies.

- Budget Control: Set spending limits for each permissible expense category, helping you keep a firm grip on finances.

- Integration Capability: Connect Zoho Expense with Zoho Books or other third-party accounting software for a seamless financial workflow.

- Automation Capability: From receipt attachment to submission-to-approval workflows, Zoho Expense aims to reduce your training time and streamline your expense management process.

Zoho Expense’s affordable pricing plan offers both a basic plan and higher-tier plans. So whether you’re a college student tracking day-to-day bills or a growing company, Zoho Expense has you covered.

3. QuickBooks Online: Seamless Integration for Tracking Expenses

Advertisement

QuickBooks Online remains a powerhouse for anyone seeking a robust app that excels at tracking expenses and more. It provides an all-in-one financial tool for businesses needing to manage both accounts payable and receivables.

Top Highlights

- Automated Categorization: Common expense types are sorted automatically, saving you hours of manual effort.

- Real-Time Cash Flow Visibility: Connect bank accounts and credit card issuers for instant access to your financial stability status.

- Invoice Creation: Generate invoices on the go, speeding up your accounts receivable process.

- Compliance Made Easy: QuickBooks Online aligns with tax regulations to simplify your tax deduction calculations.

- Integration Capabilities: Link with payroll tools, your financial institution, and various third-party apps to consolidate your entire financial system.

If you’re keen on an expense management software that grows with your business, QuickBooks Online’s advanced features—like multi-tier approval workflow and real-time transaction logging—can handle the complexity of your financial operation.

4. Mint: Personal Finance at Its Best

Mint is a personal finance app that helps you gain insights into spending pattern data by pulling info directly from your bank account, credit card, and even investment account. It’s an ideal choice for individuals who want a free tool for tracking expenses without getting into complicated business expense details.

Mint’s Highlights

- Real-Time Expense Tracking: Immediate updates let you know precisely how much you’ve spent.

- Credit Score Monitoring: See your credit score at a glance, helping you make informed decisions about future loans or credit cards with spending control.

- Budgeting Tools: Track savings goals and spending categories in an intuitive interface.

- Account Aggregation: Connect multiple financial accounts, from checking and savings accounts to retirement funds.

- Alternative Options: Some users compare Mint with Rocket Money or Monarch Money for additional features like more advanced investment tracking.

Mint may have occasional syncing issues, but it remains a popular choice for anyone seeking a user-friendly personal finance solution. It works on iOS and Android, so you can keep your finances at your fingertips.

5. YNAB (You Need A Budget): Proactive Tool for Tracking Expenses

YNAB is all about giving every dollar a job. This modern expense tracking platform promotes hands-on budgeting, nudging users to plan every expense type in advance.

What Makes YNAB Unique

- Zero-Based Budgeting: Allocate funds to specific categories—like day spending, savings goals, or debt payments—before you start spending.

- Extensive Educational Resources: YNAB offers webinars, tutorials, and guides to ensure minimal training requirement and maximum impact.

- Account Connectivity: Link multiple bank accounts, credit cards, and even student loans.

- Steep Learning Curve: The approach is thorough, but it demands consistent usage to reap real benefits.

- Pricing Structure: At $14.99 per month or $109 per year, it’s pricier than free apps but justifiable if you need advanced analytics for personal finance.

If you’re serious about developing data-driven decision habits, YNAB helps you maintain policy compliance with your own financial goals. It’s a strong option if you want to make every dollar count.

6. FreshBooks: Ideal for Freelancers and Small Businesses

FreshBooks is a cloud-based accounting solution offering powerful expense tracking capabilities. It’s got just about everything a small business or freelancer needs to handle finances with ease.

Core Strengths

- Automatic Expense Entry: Connect your bank account or credit card, and FreshBooks logs expenses automatically.

- Receipt Management: Upload paper or digital receipts to keep a detailed audit trail for tax time or financial audits.

- User-Friendly Interface: Designed to minimize the training time, its intuitive design lets you run your financial workflow smoothly.

- Customized Invoicing: Freelancers adore FreshBooks for letting them send branded invoices right from the platform.

- Regular Updates: The company consistently refines its features, ensuring reliable security with encryption and top-tier data protection.

With FreshBooks’ basic and premium plans, you can choose a package that best fits your needs—whether you’re managing a single business or multiple clients. Plus, it’s known for responsive customer support, making it a truly comprehensive expense management tool.

7. PocketGuard: Keeping Your Spending in Check

PocketGuard is like having a personal finance assistant in your pocket. It’s a popular choice for those who want a clear snapshot of how much they can spend at any moment.

Notable Features

- IN MY POCKET: Shows you how much money remains after bills, savings account contributions, and other obligations.

- Bank Account Integration: Connect a variety of financial accounts—everything from credit cards to loans.

- Manual or Automatic Entry: If you’re wary of linking your accounts, you can still add transactions manually.

- PocketGuard Plus: The premium feature offers deeper analysis and debt payoff planning for a monthly fee.

- Simplicity: The user experience is streamlined, so even a complete budgeting newbie can navigate the platform.

PocketGuard’s robust expense tracking feature ensures you stay on top of day spending. Because it focuses on user concern about overspending, it’s an essential tool for maintaining a healthy financial habit.

8. Fyle: Corporate Expense Management Simplified

Fyle is an AI-driven expense management software that makes collecting and approving business expenses a breeze. If you’re tired of chasing employees for receipts per month, Fyle does the heavy lifting for you.

Standout Features

- Machine Learning Extraction: Automatically reads receipts and codes them accurately, cutting the time spent on manual tasks.

- Multiple Submission Methods: Employees can submit their expense activity via email, web, or mobile app.

- ACH Reimbursements: Fyle offers faster reimbursement by allowing direct payouts.

- Integration with Accounting Software: Seamlessly connect to Slack, Gmail, Outlook, Microsoft Teams, QuickBooks, or Xero.

- Automation Capability: From expense policy checks to advanced analytics, Fyle offers ways to identify potential compliance issues before they become major headaches.

Keep in mind that Fyle’s standard plan may limit certain integrations. Still, for a company seeking advanced feature sets and corporate card reconciliation, it’s a competitive choice among expense tracker apps.

9. Receipt Hog: Turn Receipts into Rewards

Receipt Hog transforms mundane receipt management into a playful experience. It digitizes receipts for easy tracking expenses while also rewarding you for consistent usage.

How It Works

- OCR Technology: Automatic data extraction ensures you get accurate expense data without manual input.

- Comprehensive Reports: Generate a detailed expense report for personal finance or business expense logs.

- Multiple Submission Methods: Snap photos of paper receipts, upload them via desktop, or even email them in.

- Audit-Ready Records: Digital backups maintain compliance with IRS or CRA guidelines, simplifying the expense reporting process if you’re ever audited.

- Engaging Rewards System: Earn coins with each receipt, which can be redeemed for gift cards or cash back.

For anyone who wants an easy way to manage receipts and loves the idea of a little extra incentive, Receipt Hog offers a fun twist on standard receipt management processes.

10. How to Choose the Right Expense Tracker for You

Selecting the perfect expense tracking software isn’t just about price. You’ll want a solution that addresses your unique requirements, from credit card integration to advanced analytics. Don’t forget about key feature sets like real-time expense tracking and integration capability with your preferred bank or financial institution.

Points to Consider

- Integration with Accounting Software: Does the platform link to your existing financial tools, like NetSuite expense management or a cloud-based accounting solution? Proper integration can save you countless hours by automatically syncing data and eliminating double entries.

- User-Friendly Interface: A tool with an intuitive interface helps reduce training time. Whether you’re the finance team lead or a college student new to budgeting, ease of use is crucial.

- Policy Compliance Checks: Businesses need an expense management software that flags non-compliant expenses. Look for automated workflows with spending limit features to help your teams for reimbursement stay aligned with company policy.

- Reporting and Analytics: You’ll want advanced analytic features to see how your day spending aligns with your savings goal or monthly business expense budgets. Detailed reports also make for a smooth audit process.

- Pricing and Plans: From a basic expense tracking approach to a premium plan with multi-currency support, each app varies in cost. Make sure to check if the provider offers an affordable plan or customized pricing plan that suits your usage—especially if you’re a big organization needing employee cards or department-wise spending limits.

- Customer Support and Security: Choose a platform known for responsive customer service and top-tier app security. A mix of encryption, regular update cycles, and fraud prevention measures helps protect your data and ensures a smooth operation.

Comparing Key Features in a Quick Table

| App | Best For | Unique Selling Point | Pricing Structure |

|---|---|---|---|

| Expensify | Corporate card reconciliation | AI-powered receipt scanning | Basic & higher-tier plans |

| Zoho Expense | Budgeting & multi-currency support | Seamless integration with Zoho apps | Affordable & premium plans |

| QuickBooks Online | Comprehensive business accounting | Automated expense categorization | Monthly subscription tiers |

| Mint | Personal finance & credit monitoring | Real-time transaction updates | Free (ad-supported) |

| YNAB | Hands-on budgeting approach | Zero-based budgeting system | $14.99/mo or $109/yr |

Remember, you’re not just choosing an app; you’re choosing a strategic tool for your financial future. Whether you need advanced card features for a large business or a basic plan to keep tabs on personal finances, be sure to weigh your options based on integration, user review feedback, and your own unique financial operation requirements.

Conclusion: Embrace Tracking Expenses for a Stronger Financial Future

Tracking expenses isn’t just about numbers—it’s about clarity, control, and confidence. With so many expense tracking apps out there—each offering a variety of extensive features like real time expense tracking, receipt capture, or multi-currency support—you can easily find a solution that meets your expense management need.

Whether you’re looking to streamline corporate card reconciliation, reduce the time for employee reimbursements, or simply manage your personal spending, these ten apps can make a real difference in how you view and handle finances. By integrating an expense tracker app with your existing financial accounts, you’ll gain visibility into transaction volumes and glean insights into spending pattern trends.

Pick one of these modern expense tracking platforms that resonates with your budget, compliance needs, and desired level of automation. Then watch your money habits transform—whether that’s achieving a savings goal, ensuring policy compliance for business expenses, or simply feeling more at ease when you swipe your credit card. Here’s to a future where you track every expense with minimal fuss and maximum impact!