Creating a monthly budget is one of the best ways to ensure you’re in control of your finances. Whether you’re trying to save more money, pay off debt, or simply keep track of your spending, a budget can be your most powerful tool. But where do you start? Don’t worry, we’ve got you covered with this straightforward guide to creating a monthly budget that works for you.

1. Determine Your Net Income

The first step in building a monthly budget is to determine your net income—this is your take-home pay after taxes and deductions. It’s essential to use your net income, not your gross income, as it reflects the actual amount you have available to spend and save.

If you’re employed, this number should be relatively straightforward to calculate, as it appears on your bank statement or pay stubs. However, if you’re self-employed or a freelancer, you’ll need to subtract any expected taxes and set aside money for savings and retirement saving.

Tip: If you have irregular income, calculate your average monthly income based on the past few months, or start with the lowest month to build a buffer.

2. Identify Fixed and Variable Expenses

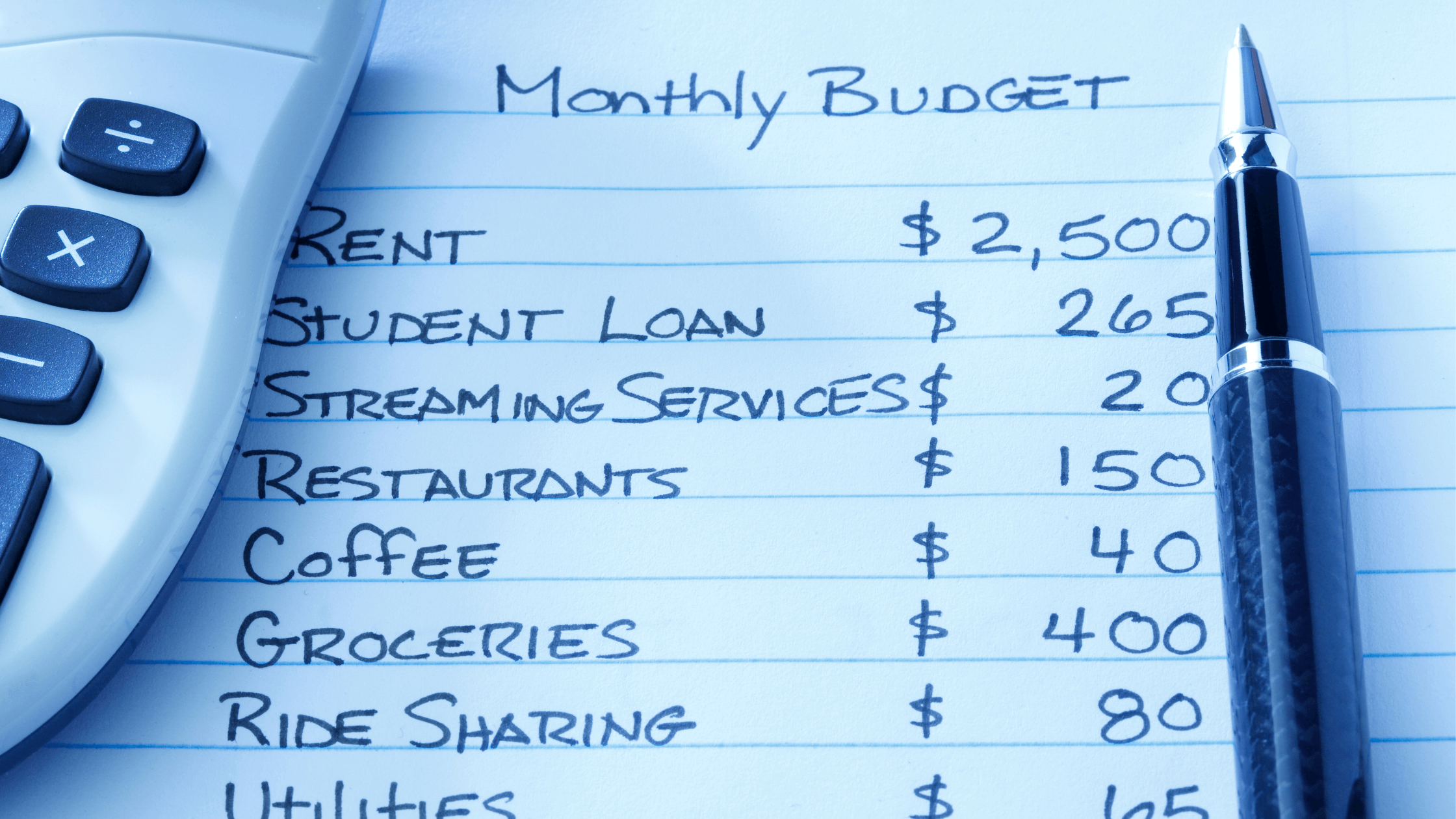

Once you know how much money you have to work with, it’s time to understand where it goes each month. Expenses generally fall into two categories: fixed expenses and variable expenses.

Fixed Expenses

These are your mandatory costs that stay consistent each month, such as:

- Rent/mortgage

- Loan payment (including student loan and auto loan)

- Insurance premium (auto, health, etc.)

- Utility bill

- Tax income deductions

These costs are relatively predictable, so they should be easy to factor into your monthly budget.

Advertisement

Variable Expenses

Variable expenses fluctuate month to month. These might include:

- Groceries

- Dining out (restaurants, coffee shops, etc.)

- Entertainment (movies, subscriptions like Netflix)

- Child care costs

Understanding your spending habits in these categories can help you adjust them to align with your financial goals.

3. Categorize Expenses Based on Financial Priorities

Next, you should categorize your expenses into “needs” and “wants.” This is crucial for managing your financial obligation and ensuring that your budget aligns with your financial goal.

Needs

- Housing (rent or mortgage)

- Utilities

- Transportation costs (fuel, public transit)

Wants

- Entertainment

- Fun money (shopping, hobbies, vacations)

You can use budgeting rules like the 50/30/20 rule to help allocate your income effectively:

- 50% for needs

- 30% for wants

- 20% for savings and debt repayment

Tip: If you’re struggling with spending, try using the envelope budget method to limit your discretionary spending by using cash for certain categories.

4. Track Your Spending for Valuable Insights

Tracking your expenses for at least 30 days is a great way to get a clearer picture of where your money is going. By doing this, you’ll identify patterns in your spending habits and see areas where you can make adjustments.

Use a budgeting app like Mint or EveryDollar, or create a budget spreadsheet in Google Sheets or Excel to track your spending. Make sure to categorize each expense and track it against your planned budget for better clarity.

Tip: Consider tracking credit card payments and loan payment amounts, as well as extra money you earn through side gigs or irregular income sources. This helps you stay aware of both expected and unexpected expenses.

5. Explore Different Budgeting Methods: 50/30/20 vs. Zero-Based Budgeting

When it comes to choosing the best budgeting method, you have several options. Here are two popular approaches:

50/30/20 Rule

This is a simple method that divides your monthly income into three categories:

- 50% to needs

- 30% to wants

- 20% to savings and debt repayment

This rule is effective if you’re just starting and want a straightforward way to manage your expenses.

Zero-Based Budgeting

In zero-based budgeting, every dollar of your monthly income is assigned a job—whether it’s for spending, saving, or debt repayment. You will need to ensure that all your income is allocated, even if it means budgeting for unexpected expenses or emergency saving. This method provides the most detailed control over your finances.

Tip: If you’re comfortable with tracking expense categories, zero-based budgeting might work best. However, if you prefer simplicity, the 50/30/20 rule might be easier to follow.

6. Set Realistic Financial Goals

A monthly budget is most effective when it’s paired with clearly defined financial goals. These goals should be specific, measurable, achievable, relevant, and time-bound (SMART). Examples of financial goals include:

- Saving for an emergency fund or retirement saving

- Paying off credit card debt

- Building a savings account for future purchases (like a home or vacation)

Once you have clear goals, you can allocate funds toward them in your monthly budget planner. Your budget worksheet should be updated regularly to track progress and make adjustments as necessary.

Tip: Break down large financial goals into smaller, manageable steps to ensure they’re achievable.

7. Use Budgeting Tools and Apps to Simplify the Process

Budgeting can be time-consuming, but thankfully, there are many budgeting tools and apps that make it easier to track and manage your money. Popular options include:

- Mint and EveryDollar for automatic tracking and categorizing

- Google Sheets or Excel for custom budget spreadsheets

- Budgeting calculator tools to help determine how much you should save or spend

Using these tools can save time and reduce the effort needed to manage your budget effectively. Plus, some apps allow for automatic payments to help you stick to your budget plan template without hassle.

Tip: Use an online tool or budget app that syncs with your bank account to automatically update transactions, helping you avoid manually entering every expense.

Conclusion

Creating a monthly budget is an essential step towards achieving financial freedom. By determining your net income, categorizing your expenses, setting financial goals, and using budgeting tools, you can take control of your money and achieve your money goals. Whether you’re saving for an emergency fund, paying off debt, or planning for retirement saving, a well-organized budget helps you stay on track and make the most of your monthly income.

Remember, the key to sticking with a budget is consistency. Review your budget regularly, track your spending, and adjust your plan as needed to stay aligned with your financial priorities.

FAQs

How Do I Stick to My Budget?

- Track your spending regularly to ensure it aligns with your goals.

- Use simple methods like the 50/30/20 rule to allocate your money effectively.

- Build an emergency fund for unexpected costs and stay disciplined in following your plan.

What Should I Do If I Overspend?

- Reevaluate your spending habits and identify areas to cut back.

- Adjust your budget category allocations if necessary.

- Avoid using credit cards to cover overspending; instead, make cuts to discretionary spending.

Can I Adjust My Budget Mid-Month?

Yes! It’s important to be flexible. If you experience unexpected expenses or income, make the necessary adjustments to stay on track.

How Can I Save More Effectively?

- Reduce discretionary spending, like eating out or entertainment.

- Look for ways to lower bills, such as negotiating with service providers.

- Set SMART goals to stay focused on your savings targets.

By following these steps, you can build a realistic budget that not only helps you manage monthly bills but also moves you closer to financial health and achieving your money goals.